Gold and silver are always considered to be safe from an investment standpoint. As precious metals, they are the first commodities people around the world turn to when they predict an economic or financial crisis, as it helps them protect their investment.

When thinking about investing in either gold or silver, it is important that you consider the pros and cons of investing in each precious metal. Depending on the type of crisis at hand, one might prove to be a better choice over the other. So without further ado, let’s discuss them both.

Should You Invest in Gold?

Pros

Safe haven: This is perhaps the most common reason why people own gold. It’s considered to be a currency all on its own, meaning that it can store value, especially in times of economic distress.

Gold Supply: Just as with most other commodities, it is becoming harder to find new deposits. Even if a new source is discovered, the cost of excavation is quite high. This helps in stabilizing the price of gold rather than making it fluctuate.

Stock Market: The stock market is a good place to make money recently and let’s hope it remains that way. However, if you begin to witness distress on Wall Street, pulling out your money and investing it in gold will be a good idea.

Cons

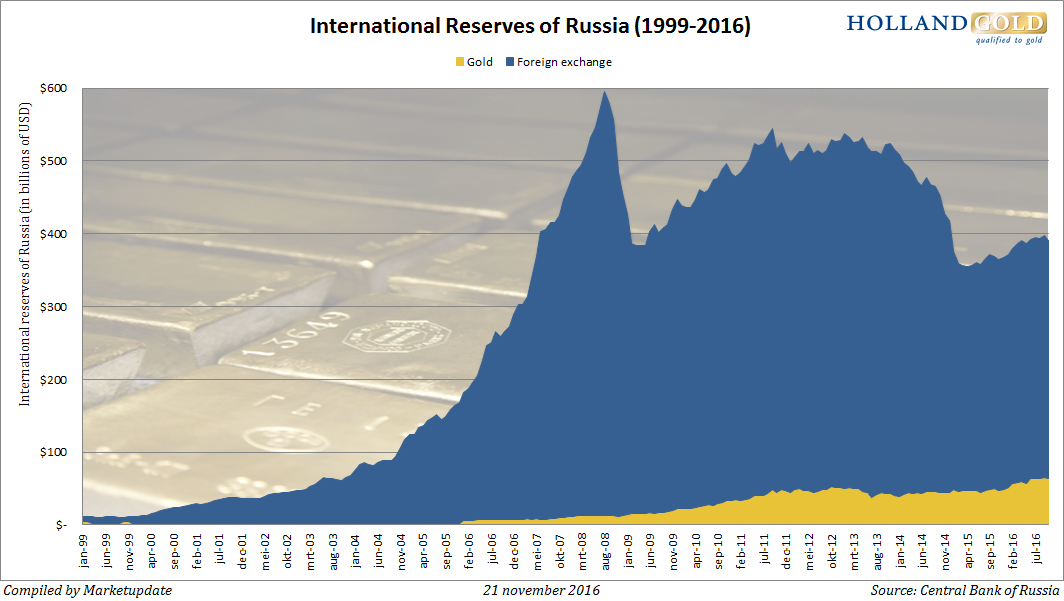

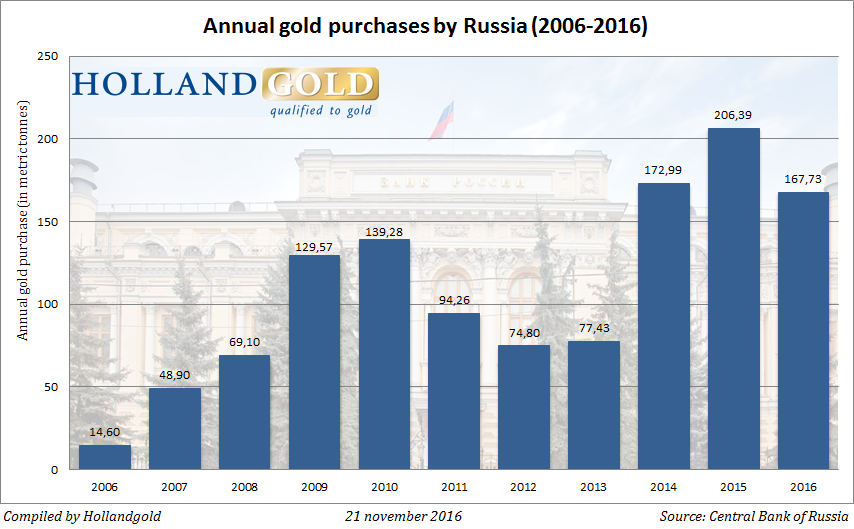

Central Banks: The major demand for gold often comes from developing economies that have had budget surpluses. They use this surplus to buy gold reserves in an effort to appreciate their currency. One forecast is that gold buying is likely to drop by 34% this year.

Dead Money: While gold may have a certain appeal to it, it just lies there and doesn’t make you any more money unless you feel that the price is high enough for you to sell it. Even then, you are only earning the difference. If the market seems stable for now, you might want to consider investing in stocks, which at least will yield dividends.

Should You Invest in Silver

Pros

Diversification: In the context of the stock market, you might hear a lot about

diversification. Typically, it means not placing all your eggs in one basket and spreading your investment to minimize risks, for instance, investing in both large and small companies. However, precious metals tend to have a lower correlation to other investments, so if your stocks seem to be declining, the price of silver may increase.

Return: Another reason to invest in silver is simply to make some money off of it. Silver prices fluctuate often by leaps and bounds; the trick is to keep an eye on the prices and to take advantage of them at the opportune moment.

Cons

Hassle: Buying silver, taking possession of it and holding on to it until prices rise is a big hassle. Not to mention, when you want to sell it, you have to physically carry silver from your home and take it elsewhere to sell it off.

Better alternatives: Silver prices are dependent on economic activity, so when the economy is strong, this metal does quite well. Unfortunately, when the economy is strong, you also have better alternatives available to make money than silver, for instance, the stock market; so determine whether you do really want to invest in it or not.

About Gold Bullion Australia: Gold Bullion Australia assists clients from Melbourne, Sydney, Brisbane, Adelaide, Perth and all over Australia in buying precious metals like gold and silver. They stock leading LBMA certified goldbars and silverbars from refiners like PAMP Suisse, Perth Mint, Ohio Precious Metals and NTR for their customers.