Last month China has imported 80,6 tonnes of gold from Hong Kong, a 27,6% drop compared to the 111,4 tonnes imported in the month of February. Imports dropped as well compared to the same month last year. In March 2013, net imports of gold from Hong Kong were about 130 tonnes. The Hong Kong Census and Statistics Department publishes monthly data on the Chinese gold imports from Hong Kong. The figures about March 2014 also show in increase in gold leaving China. Compared to February, the gold exports back to Hong Kong increased from 15,8 to 23,5 tonnes of gold.

These numbers suggest a drop in demand for physical gold in China. However, the figure of 80,6 tonnes of gold imported remains substantial. While it may be less than the amount of gold imported in 2013, it is well above the long-term average. Another side note we have to make is that China does not publish data on gold which enters the mainland directly through Shenzhen, Shanghai or Beijing. There are no exact figures on direct gold imports, but the most recent estimate states a volume of more than 190 tonnes during 2013.

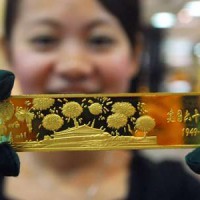

China imports less gold

Last year we saw an explosive growth in Chinese gold demand, but the last couple of months demand has waned a little. The goldprice didn't drop further from 2013 lows, but it hasn't made a big move to the upside either. The relative price stability allows the Chinese consumer to wait before buying gold. Because of the drop in gold demand, the premium on gold in China has fallen substantially. For the first time since September 2012, the gold at the Shanghai Gold Exchange trades at a small discount to the global spot price of gold. In March, the average discount was $1,02 per troy ounce. The largest jewellery producer in China, Chow Tai Fook Group, saw a small drop in demand as well. In the first quarter of 2014 the demand increased by just 4%, compared to 11% in the last quarter of 2013. According to Liu Xu, analyst of Capital Futures Co in Beijing, the big banks in China reduced their imports because of the fall in gold premium. According to Duan Shihua of Shanghai Leading Investment Management Co, Chinese consumers might be more price-sensitive than expected.China imported less gold in March